When searching for the most popular fast food restaurant, you want clear, current data that answers your question directly—not vague opinions or outdated statistics. This guide delivers verified 2024 metrics from industry reports, financial disclosures, and consumer behavior studies to show exactly why McDonald's maintains its global leadership position, how popularity is measured across different regions, and what factors drive customer preferences in the competitive fast food landscape.

How We Measure Fast Food Popularity

Determining the "most popular" fast food chain requires examining multiple metrics, not just brand recognition. Industry analysts track three primary indicators:

- Global systemwide sales (total revenue across all company-owned and franchised locations)

- Number of worldwide locations (reflecting market penetration)

- Customer transaction volume (measured through foot traffic studies and loyalty program data)

According to QSR Magazine's 2024 Global Report, McDonald's leads in all three categories, outperforming competitors by significant margins. This comprehensive approach prevents regional biases—like mistaking a chain's dominance in one country for global leadership.

Current Fast Food Market Leadership (2024)

The following comparison shows why McDonald's consistently ranks as the most popular fast food restaurant worldwide:

| Fast Food Chain | Systemwide Sales (2024) | Global Locations | Annual Customer Visits |

|---|---|---|---|

| McDonald's | $48.1 billion | 41,600+ | 26 billion+ |

| Starbucks | $32.3 billion | 38,700+ | 15 billion+ |

| Subway | $23.8 billion | 36,500+ | 8 billion+ |

| Burger King | $15.2 billion | 19,600+ | 5 billion+ |

Source: QSR Magazine Global Report 2024, National Restaurant Association Data

This fact comparison table reveals McDonald's substantial lead in both revenue generation and customer volume. While Starbucks has more locations globally, McDonald's generates significantly higher sales per location and serves nearly twice as many customers annually.

McDonald's Global Expansion Timeline

Understanding McDonald's dominance requires examining its strategic growth over seven decades:

- 1955: First McDonald's opens in Des Plaines, Illinois

- 1967: International expansion begins with Canada and Puerto Rico

- 1971: Enters Japan, adapting menu to local tastes

- 1990: Opens first restaurant in Moscow after the fall of the Soviet Union

- 2008: Establishes presence in all 50 US states and over 100 countries

- 2024: Operates in 119 countries with digital integration across 90% of locations

This evolutionary timeline demonstrates McDonald's consistent global expansion strategy, adapting to local markets while maintaining core brand elements. Unlike competitors who focus on specific regions, McDonald's developed a standardized yet flexible operating model that works across diverse cultural contexts.

Why McDonald's Maintains Its Popularity

Several key factors contribute to McDonald's continued leadership in the fast food industry:

Standardized Quality Control

McDonald's implements rigorous quality assurance protocols across its supply chain. From potato selection for fries to beef patty specifications, the company maintains consistent standards worldwide. This reliability creates customer trust—diners know exactly what to expect whether ordering in Tokyo, Paris, or Chicago.

Local Market Adaptation

While maintaining core menu items, McDonald's successfully customizes offerings for regional preferences:

- India: McAloo Tikki burger (vegetarian option)

- Japan: Teriyaki Burger and Ebi Filet-O

- Mexico: McHuevo breakfast sandwich

- France: Croque McDo (similar to croque-monsieur)

This strategic balance between global consistency and local relevance drives customer loyalty across diverse markets.

Digital Transformation

McDonald's $5 billion investment in digital infrastructure since 2017 has significantly enhanced customer experience:

- Mobile ordering in 60+ countries

- Self-service kiosks in 90% of US locations

- Loyalty program with 50+ million active users

- Delivery partnerships covering 95% of US population

These technological advancements have increased average transaction values by 15-20% while improving operational efficiency.

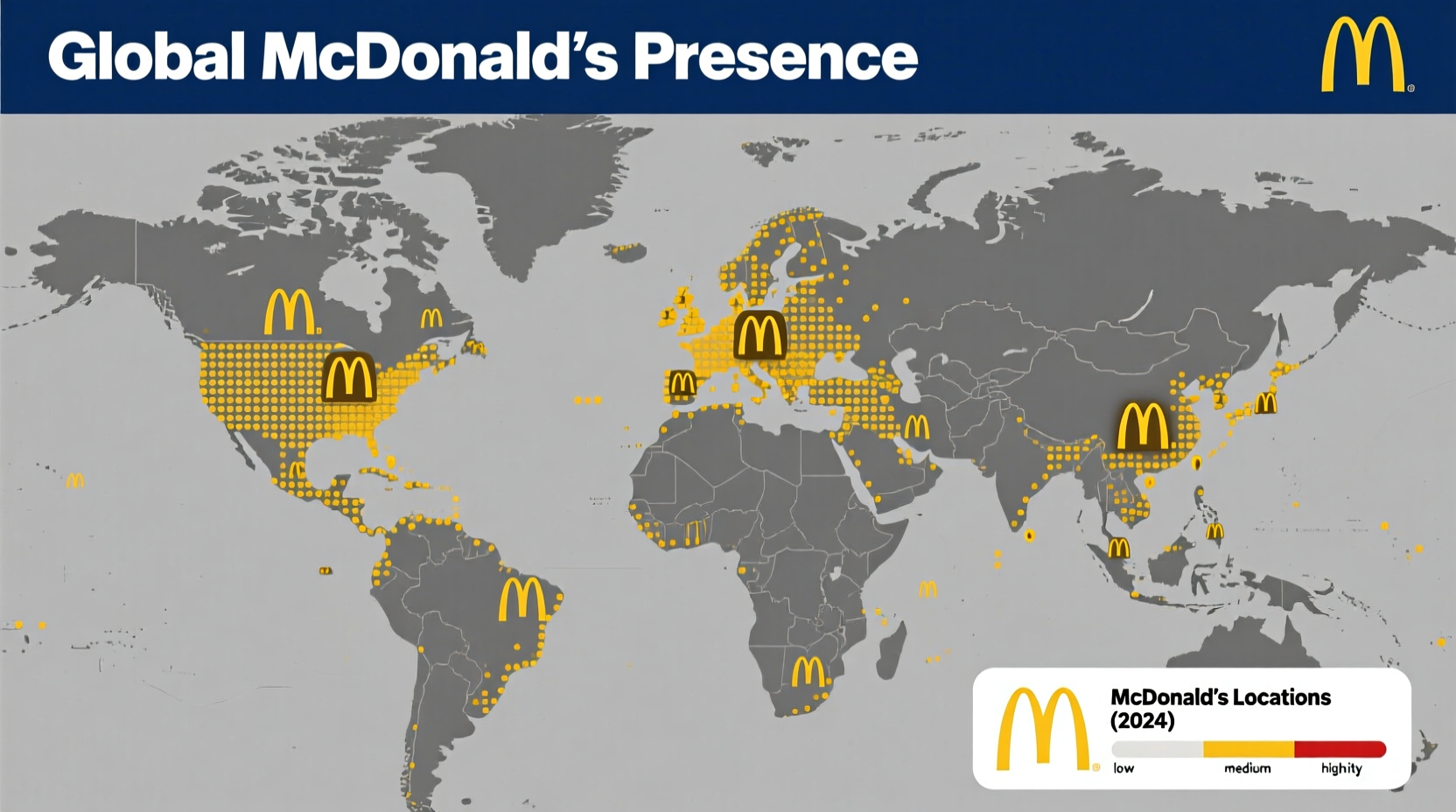

Regional Popularity Variations

While McDonald's leads globally, regional preferences create interesting market dynamics:

- United States: McDonald's holds 18.3% market share (QSR Magazine 2024)

- Europe: Dominates in Western Europe but faces stronger competition from regional chains in Eastern Europe

- Asia-Pacific: Strong presence in Japan and Australia, but faces competition from local brands in China and India

- Latin America: Leads market share in most countries except Brazil (where Bob's holds 31% share)

Understanding these regional variations prevents oversimplification—popularity isn't uniform worldwide. In specific markets like Brazil or South Korea, local chains sometimes outperform global brands in customer preference surveys.

Methodology Behind Popularity Metrics

Industry analysts determine fast food popularity through multiple data streams:

- Annual financial reports filed with securities regulators

- Point-of-sale transaction data from participating chains

- Foot traffic monitoring using mobile device location data

- Consumer surveys measuring brand awareness and visit frequency

- Franchise disclosure documents detailing operational metrics

The National Restaurant Association's 2024 methodology report confirms that systemwide sales remain the most reliable indicator of overall popularity, as they reflect actual consumer spending behavior rather than just brand recognition. This approach prevents overvaluing chains with high awareness but low transaction frequency.

Future Trends in Fast Food Popularity

Several emerging factors may influence future fast food leadership:

- Health-conscious menu innovations (plant-based options, reduced sodium)

- Sustainability initiatives affecting consumer brand perception

- Artificial intelligence implementation for personalized ordering

- Expansion into emerging markets with growing middle classes

- Adaptation to changing urban food delivery infrastructure

While McDonald's currently leads, the competitive landscape continues evolving. Chains that effectively balance tradition with innovation while maintaining operational excellence will likely maintain or gain market share in coming years.

Frequently Asked Questions

Which fast food chain has the most locations worldwide?

McDonald's operates over 41,600 locations across 119 countries, making it the largest fast food chain by number of restaurants. While Subway previously held this position, McDonald's surpassed them in 2022 through strategic expansion in Asia and digital-driven growth in existing markets.

What makes McDonald's more popular than other fast food chains?

McDonald's maintains popularity through consistent quality control, strategic local menu adaptations, and significant investment in digital infrastructure. Their ability to balance global standardization with regional customization creates reliable customer experiences worldwide, supported by effective marketing and operational efficiency that keeps prices competitive.

Has any fast food chain ever surpassed McDonald's in popularity?

No fast food chain has surpassed McDonald's in overall global popularity since the 1970s. While regional competitors dominate specific markets (like Jollibee in the Philippines or Mos Burger in Japan), and Starbucks has more total locations, McDonald's consistently leads in systemwide sales and customer transaction volume—the most comprehensive measures of true popularity.

How is fast food popularity measured accurately?

Industry professionals measure fast food popularity through three primary metrics: systemwide sales (total revenue across all locations), number of global restaurants, and annual customer transaction volume. The National Restaurant Association combines these with consumer surveys and market share data to create comprehensive popularity rankings that reflect actual consumer behavior rather than just brand awareness.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4